There are lots of credit score calculators, but Aliche recommends focusing on your FICO score. South Africa’s leading home loan comparison service, ooba Home Loans, can apply to multiple banks on your behalf and has been successful in securing home loan financing for two in every three applications that are initially turned down by their bank.Life Kit 'Tis The Season: Coping With SAD, Or Seasonal Affective Disorder

Close accounts when you’ve paid the balance owing.Avoid owing more than a third of your gross income on debt.It’s a good idea to get your credit card debt down first and keep the balances low because credit cards often carry the highest interest rates.Without them, the credit bureaus won’t be able to assess the risk associated with your application. As much as we don’t like to be in debt, having accounts is a must when it comes to applying for a home loan.Avoid spending up to your credit limit.Keep servicing your debt, only dipping into available credit when you really need to and reduce your credit limits where possible.Try and pay more than just the minimum instalment.

#Good credit score full#

They’ll be able to access your employment history and income as well and calculate your credit score according to a complex formula. The credit bureaus won’t only be looking at your repayment history.

#Good credit score free#

This is a 100% secure, online tool that is available free of charge and without any obligations.

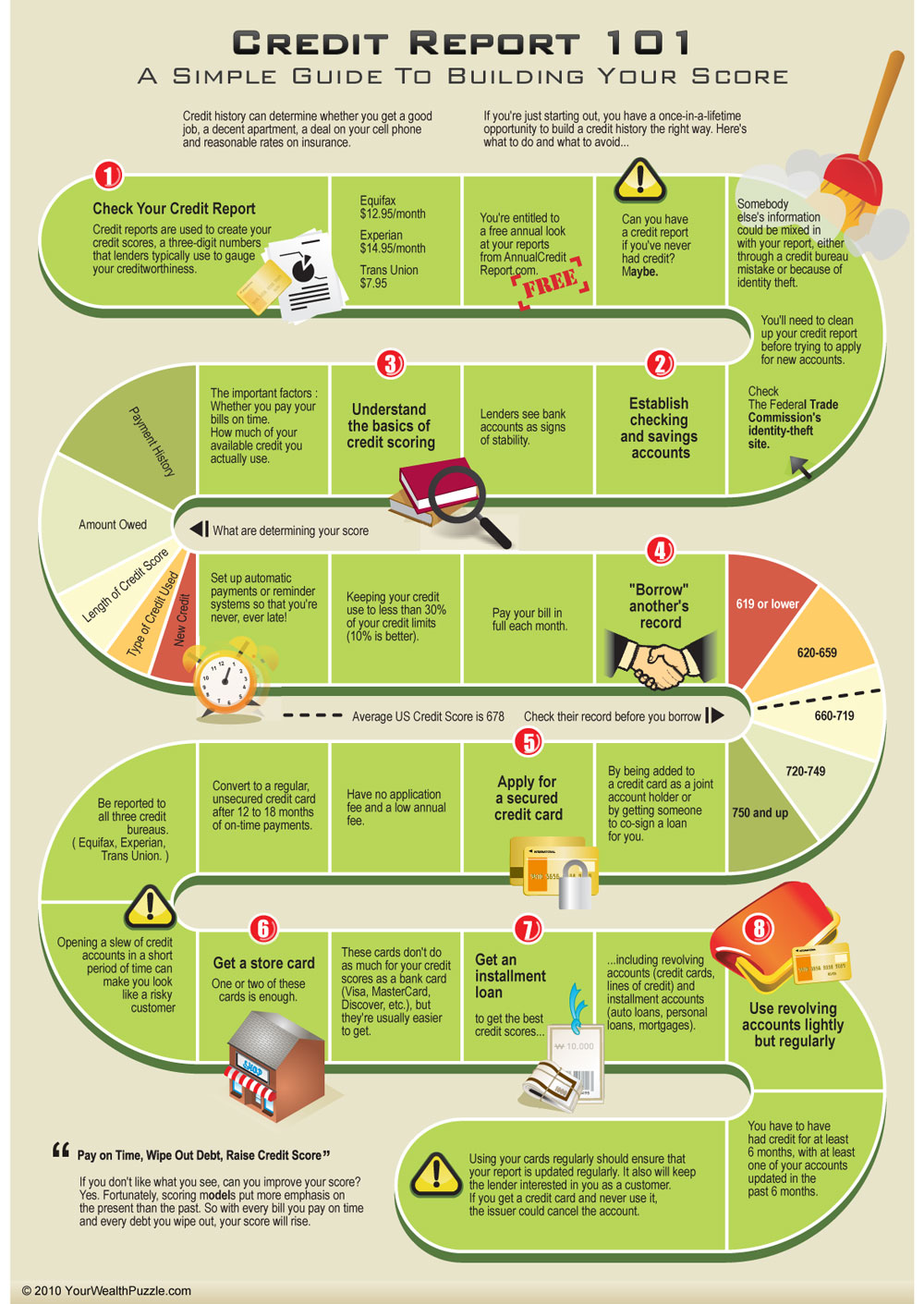

You want your credit score to at least be 610. So what credit score should you be aiming for? What is a good credit score? A good credit score will give you the best chance of getting your home loan approved. Your credit score is a three-digit number that tells the bank how much of a risk you are. You can request your free credit score annually from a credit bureau, or by using ooba Home Loans’ Bond Indicator tool. Your credit score is determined by how well you manage your debt, how many accounts you have and how long you’ve had them, among others.A high credit score will smooth the way to a successful home loan application.A credit score above 800 is considered excellent. A credit score should be at least higher than 610.Your credit score is a big three-digit number above your head that tells a potential lender how much of a risk you are.

0 kommentar(er)

0 kommentar(er)